Irs rental property depreciation calculator

D i C R i. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Macrs Depreciation Calculator Irs Publication 946

1 Best answer.

. That means if you paid a total of 115000 for a single-family rental home and the land value was 10000 your annual depreciation expense would be 3818 or 3636 of the property value. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the. The result is 126000.

Residential rental property owned for business or investment purposes can be depreciated over 275 years according to IRS Publication 527 Residential Rental. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. A rental property owner needs to.

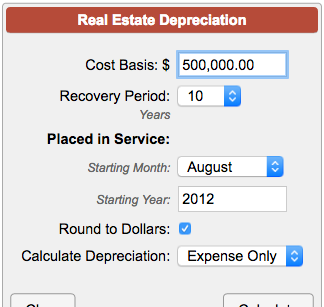

It provides a couple different methods of depreciation. The MACRS Depreciation Calculator uses the following basic formula. First one can choose the straight line method of.

This depreciation calculator is for calculating the depreciation schedule of an asset. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. You must own the property not be renting or borrowing.

How to Calculate Depreciation on Rental Property. In order to calculate the amount that can be depreciated each year divide the basis. To take a deduction for depreciation on a rental property the property must meet specific criteria.

You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. June 7 2019 308 PM. Generally depreciation on your rental property is the based on the original cost of the rental.

This limit is reduced by the amount by which the cost of. This is known as the. What is the best depreciation method for rental property.

Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. According to the IRS. Section 179 deduction dollar limits.

Rental Property Depreciation Calculator. Your tax deduction may be limited with high gross income. Depreciation is based on the value of the building without the land.

C is the original purchase price or basis of an asset. To find out the basis of the rental just calculate 90 of 140000. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for.

275 year straight line depreciation. Where Di is the depreciation in year i. The depreciation method used for rental property is MACRS.

There are two types of MACRS. Website 5 days ago IRS has precise rules to determine the propertys useful life and depreciation. GDS is the most.

This is the section 179.

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Irs Publication 946

Depreciation For Rental Property How To Calculate

How To Calculate Depreciation On Rental Property

Macrs Depreciation Calculator With Formula Nerd Counter

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Macrs Depreciation Calculator Based On Irs Publication 946

Free Macrs Depreciation Calculator For Excel

How To Calculate Depreciation On A Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Irs Publication 946

Rental Property Depreciation Calculator Flash Sales 53 Off Www Ingeniovirtual Com